Investing through bots is a great way to access complex (but highly profitable) assets in the crypto space. For example, let’s say, you want to invest in the emerging AI and machine learning tokens in the crypto markets. This is an attractive investment idea, given the traction seen in the AI segment over the recent past. However, the amount of time and effort one has to spend, to study, understand and identify good AI crypto projects, is enormous.

One alternative is to find and invest in a trading/investing bot from a professional trader, who would’ve done the homework already. But the safety questions come to the fore – will the trader run away with my funds? Will the platform fold up, leaving me in the lurch? How about anonymity?

These security concerns are valid. Ideally, the platform on which the bot is available, should address all these security concerns to your satisfaction.

The illusion of safety in Centralized Exchanges

People often think of centralized exchanges (CEs) such as binance, as a safer alternative to smaller players. But this is just an illusion. Larger platforms can and do block funds and mess up wallets. Case in point – binance has blocked transfer of SOL tokens from being transferred off the platform. Also, the legal authority in your country may ban the platform, making it difficult or impossible for you to retrieve your funds. Case in point – the Indian government banned the largest crypto exchanges like binance, kucoin, kraken just overnight, with millions of dollars locked into these platforms from India.

Even large scale crypto operations can get scammed – case in point, hedgey finance – a hacker pulled out $million across multiple networks and over $2 million is still stitting in his account (as of this writing) – https://etherscan.io/address/0xd84f48b7d1aafa7bd5905c95c5d1ffb2625ada46

Despite being big, centralized crypto exchanges are not immune to losing your funds – case in point, FTX – A surge of customer withdrawals, due to concerns over questionable financial valuation practices and unusually close relationship with Alameda, pushed FTX and Alameda into bankruptcy.

Also, centralized exchanges have their own proprietary wallet system – your funds are transferred to wallets owned by the CE. Even though they show you that your have so-and-so balance, they can simply delete their wallet software (or someone cracks their system) and your funds are gone for ever. This risk is somehow missing to register in the common psyche – people think this won’t happen, but it is as real as it can be.

What about on-chain AMMs?

Are the on-chain AMMs (Automated Market Making) smart contracts any better? Yes, they are, in the sense that the code of these smart contracts are open source and well-verified. However, many AMM contracts take full allowance (i.e. approval from you) to spend all the money in your wallet, though they may only execute the quantity you’ve specified. This opens up a security risk that any vulnerability in the smarkt contract code may translate into losing control of your funds, since the allowance is there.

But for a discerning user, the on-chain options are way safer than the centralized exchanges.

Trading bots Platforms

While centralized exchanges offer simple coin trading, a more sophisticated user looking for easier, better way of making money, will discover the crypto trading bots platforms such as catbots (fully on-chain bots), cryptohopper (mix of trading bots, mining, fund management services), 3commas (exchange-specific signal-based bots), Haasonline (desktop app based bots), etc. They are usually more robust, consistent and more disciplined in making money from crypto trading, by employing much more sophisticated, risk-managed and fast trading systems.

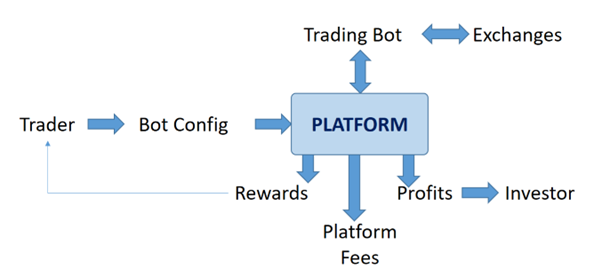

These platforms enable skilled traders with well-defined, backtested and automated strategies to reach the investors looking for better profits and vice versa. For the traders who put up their bots, the platform gives them the ability to access trading capital, while providing investors with more profitable options that are not available elsewhere. The typical structure of these platforms is shown below.

Security aspects of bot platforms

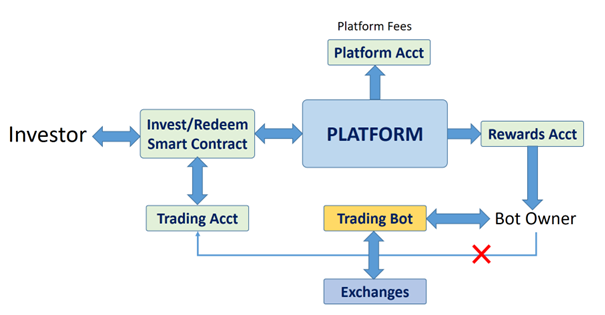

As the conduit between bot owners and investors, the trading platform hold the responsibility to ensure safety for the investors, stability for the traders and well-defined, fair and systematic sharing of the proceeds – profits for the investors, good commission for the bot owners and fair charges for the platform. The best way to streamline these distributions, is to implement them in smart contracts – they are immutable, always online and the details are available in the public ledgers for everyone to see.

Apart from proper distribution mechanism, the platform should also ensure safety of the investor’s funds. The funds should be held by the platform account and not by the trader’s own account. This will ensure that the trader can’t rug-pull the funds. But still the platform will have the ability to rug-pull it themselves, however, such an action will destroy the platform’s reputation and the investments will stop immediately.

As such, the platform is naturally motivated to ensure the safety of the investors’ funds, resulting in a win-win for everybody.

By denying direct access to trading funds, the platform entirely avoids any possibility of rug-pull by the bot owner. By ensuring that the bot can trade only on a pre-defined set of coins, the platform also ensures that the funds can’t be siphoned off through dubious coins. Since the risk profile of the bot is known and agreed-upon by the platform and the bot owner, the trading risk remains within the envelop as specified to the investors.

By enshrining the rewards logic into the smart contracts, the bot owner is assured of his fair share of the earnings from his bot. This improves the trust in the platform, both for the bot owners and investors.

The catbots safety net

The catbots platform implements all the above best practices to provide a robust, secure and rewarding experience to the bot owners and the investors. Apart from the standard secure fund access mechanisms, the catbots platform issues dollar-pegged (USDC-pegged) bot tokens, so that investors can easily comprehend the earnings, sell their tokens in the offline market or redeem them to book profits.

With 100% of the trades done on-chain, there are no possibility of the funds vanishing into thin air. Everything is traceable on-chain, transparent and 100% verifiable by anyone. As such, catbots remains as a pioneer in safe, robust on-chain trading-bots market place in the world.

Leave a Reply