For any trading bot, a sacred rule is to allow users to deposit and withdraw funds at any time. Locking the capital indefinitely will inevitably lead to lose of investor confidence on the bot and the platform.

However, it is difficult for a bot to provide this “invest-and-redeem-anytime” function without compromising profitability to some degree. Because profits are made by using the funds to take timely positions and keeping them open until some profitable outcome happens. If the user withdraws the funds before that, then the bot has no choice but to partially (or fully) exit the position, book a loss if so and return the money to the investor.

On top of the potential loss, this out-of-turn position exit will also incur additional charges, in terms of gas costs, bridging costs and price slippages. This works against the goal of making money, thereby degrading the bot performance.

The Balancing Act

So it is a double-edged sword – allowing fund in-and-out at any instant will boast user confidence, but impacts bot profitability and not allowing it will improve bot performance, but impact investor confidence.

A good trading platform will have to devise an intelligent cash management process to ensure that a balance is achieved between the two extremes.

The Multi-chain Cash Flow

The problem of allowing arbitrary withdrawals from a bot trading across multiple chains, is an expensive affair. Not only the trading charges, but the bot will also incur ultra-expensive bridging cost, which is an order of magnitude higher than the trading fees. Also, it takes several minutes, if not hours, to complete the bridging process.

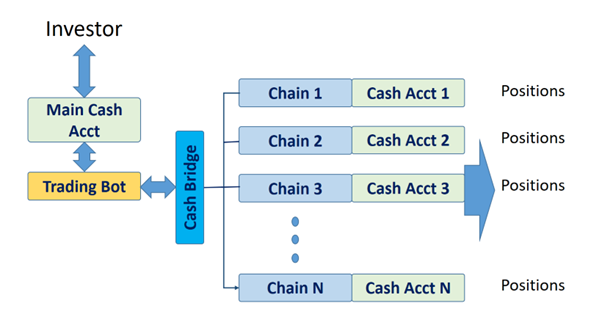

The overall cash flow looks like this.

Based on the liquidity, sometimes it may be impossible to (partially) close a positions in a particular chain, because there may be zero liquidity for that position (i.e. nobody wants to buy the token you want to sell). This results in investor not able to withdraw his funds immediately.

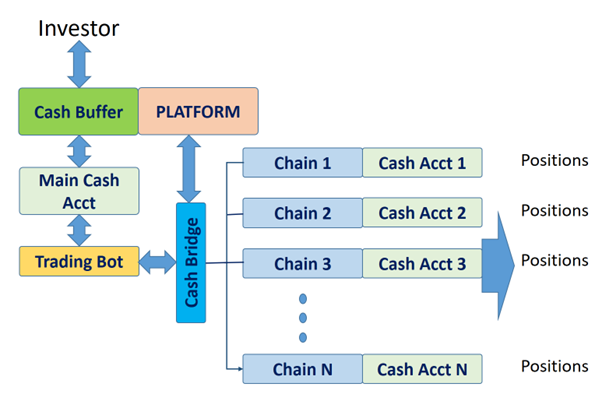

Enter – The Cash Buffer

So what can be done? A neat way of managing this situation, is to keep certain percent of the cash as a “cash buffer”, so that when an investor wants to withdraw, he can do so to the extent of cash available in the buffer.

Let’s say 10% of the total inflow is kept in the cash buffer for instant withdrawals. When the balance in the cash buffer reaches 0, then the platform (and bot) will check whether it can be replenished with the funds available in the chain-specific cash accounts. If this is viable, then these funds are bridged back to the primary chain and the cash buffer is filled up.

If that is not sufficient, then platform will tell the bot to exit adequate number of positions, as uniformly as possible across all chains, bridge the funds back into the primary chain and fill up the buffer again.

Better Investor Experience

This methodology provides almost instant redemptions for most of the investors, because in a large system, in a steady state, typically only a small percent of the funds are redeemed. The cash buffer balance is designed to service this outflow most of the time. However, sometimes the investor may encounter the message “Insufficient balance in cash buffer. Please try after some time”.

While this is not something the investor will like, but he can always try smaller amount (below the cash buffer balance) to withdraw as much as he can.

This provides a nice compromise between bot profitability and investor’s need to withdraw. The overall user experience is far better than otherwise.

The Sea-saw Buffer Cash Flow

Usually during stressful market conditions, many users tend to withdraw at once. To manage these situations effectively, a “Sea-saw” cash flow can be used.

In this method, the cash buffer will initially hold 10% of the total investments. When the balance approaches zero due to heavy outflow, the platform will evaluate the situation and withdraw more than 10% (say 20%) from the sub-chain cash accounts and closure of positions, so that the cash buffer is filled up to 20% of the total available investments.

This method will ensure that investor withdrawal experience is much better than otherwise.

The Best of Both Worlds

While such a cashflow management system is more complex to implement, it strikes a beautiful balance between investor experience and bot operations, with a little compromise on both sides.

While the investors can withdraw their money most of the time, they may have to wait for a period during market stresses. But the wait will not be indefinite – the cash buffer will fill up soon and he will be able to withdraw the remaining amount.

This works out better for the bots as well – they need not bridge small amounts, incurring huge bridging costs. They can wait for the consolidation point and process a larger chunk of bridging, there by significantly reducing operational costs and opportunity losses.

The catBots Advantage

The catBots platform has this intelligent, balanced cash flow management for delivery optimal user experience, without overly compromising the bot profitability. Additional measures such as smartly bridging booked profits based on market conditions, adaptive buffer management, etc. Working in harmony, this active cash management system provides good user experience without compromising bot performance.

Leave a Reply